Everyone Can Make More Money

Everyone across the income spectrum is capable of making more money. Money is a choice. Once you see that, you cannot unsee it.

“Why are we falling behind?”

Some people treat Thanksgiving as a warm-up for Christmas shopping. They stuff themselves with turkey, exchange a few pleasantries with family, and start spending.

Spend Your Money

We are all getting older.

I’m faced with my own mortality every day when I look in the mirror—my hair has gone from 10% grey to 70% grey in the last two years. Sure, I could dye it, but that would look ridiculous.

Meanwhile, my idea of exercise these days is walking for 30 minutes on the treadmill. Carrying groceries up the stairs wears me out. And I go to bed at 9:30 every night, exhausted.

Like I said, we are all getting older. And as much as I hate to say this, we are all going to die someday. So, today we are going to talk about another immutable reality…

-

You cannot take your money with you.

Back when I was doing the radio show, I spoke with a guy named Bill Perkins. He’s very successful—nearly a billionaire. And he wrote a book called Die with Zero. The title pretty much says it all—you want to spend all of your money before you die. And I more or less agree.

Sure, you probably want to leave a bit behind for your family. But don’t leave too much! That would only take away their incentive to work. And you might wind up with children or grandchildren who are feckless Trustafarians.

I’ve met plenty of those “kids.” The first fancy vacation I ever took was to Turks & Caicos. I stayed at the Gansevoort Hotel. And there was a group of 18- or 19-year-olds spending the week there, too, throwing around a ton of money. It was one of the craziest things I’ve ever seen.

My guess is your financial goals do not include funding that sort of tropical teenage excess. So, once you make a lot of money, and save plenty for retirement, by all means, start spending some of it.

The Cutoff Point

During the first chunk of your adult life, you want to live below your means. It’s just easier to tolerate cheap clothes, a rundown apartment, and canned beans for lunch when you’re 25 years old.

Save as much as humanly possible during those early years. Then, around age 45, and certainly by age 55, you should be in a position to spend more on the things you want. Personally, I like clothes and travel. But it’s your money, so spend it on whatever makes you happy.

People have a hard time making this transition. But please, if you are over age 55, debt-free, with plenty of cash to cover emergencies and a robust retirement account, spend some money. Take a trip. Buy a fancy car. Heck, if you have the money and want to buy a boat, by all means, go for it. Because again, we are all going to die someday.

How Much?

I’m not suggesting you deplete your retirement funds. A lot of people worry about that. In fact, readers ask me about it all the time. “How much can I spend in retirement without going broke?”

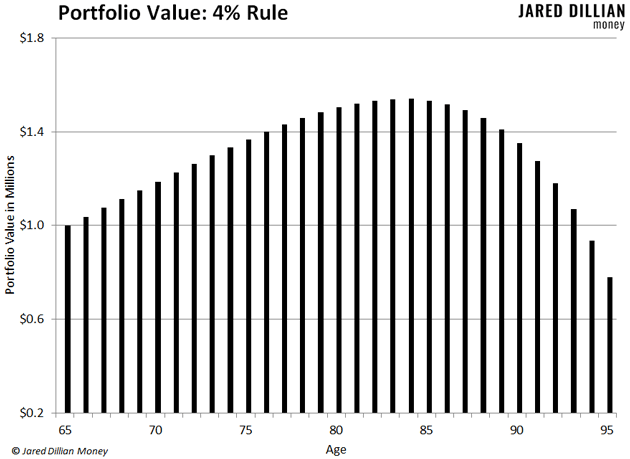

The “4% Rule” is a good benchmark here—I mentioned that during the Q&A on Monday. I’ll take you through an example of how it works.

Say, you retire at age 65 with $1 million in the bank. You can withdraw 4% of that for the next 30 years, and you will still have $778,697 when you are 95. (This assumes a 7.7% compounded annual return, which is the historical return on a portfolio of 50% stocks/50% bonds for the last 48 years.)

In other words, you can spend 4% without worrying much. And the more you’ve worked and saved, the more you can spend, worry-free.

Jared Dillian

|

Monkey See, Monkey Do

You’ve probably heard that people are quitting their jobs and getting rich trading crypto. Maybe you’ve even thought about it. It’s monkey see, monkey do.

Everybody Has Stories About Shortages Right Now

Everybody has stories about shortages right now.

‹ First < 24 25 26 27 28 > Last ›